Gambling Winnings 1040 Line 21

Reporting and writing off gambling amounts Tell the IRS about your lucky income on line 21 of Form 1040, line 21. If you itemize, you get a chance to reduce your gambling earnings. On line line 28, Other Miscellaneous Deductions, of Schedule A, report any gambling losses. You can claim up to the total amount you won (and reported on your 1040), effectively wiping out any taxable gambling income.

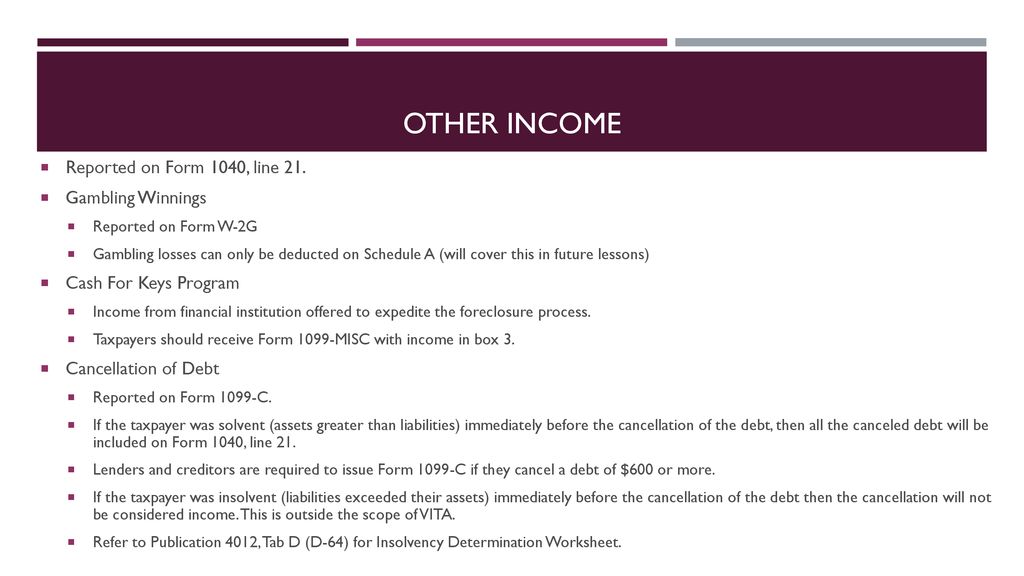

The winnings reported on line 21 of the Form 1040. L You must be able to substantiate any losses claimed. Caution: Do not net winnings and losses. You cannot subtract your losses from your winnings when reporting your gambling income. The total income is reported on Line 21 of Form 1040 and losses (up to the amount of winnings) are claimed by itemizing deductions on Schedule A. Winnings from gambling and contests—including office pools—are reported on line 21 of IRS Form 1040. But Line 28 on Schedule A is bust. Losses for the year, meanwhile, are reported on line 28 of Schedule A from Form 1040. Gambling losses can’t outweigh winnings. An unlucky streak has its limits when it comes to preparing your tax return. You can’t report gambling losses that total more than your winnings for the year. Use Form 1099G to report your gambling losses on your federal income tax return. The IRS mails this form no later than Jan. It shows the total amount of your gambling winnings, which you must claim on Form 1040, line 21. Obtain Schedule A, the itemized deductions form for your federal income tax return.

More Articles

If you had a successful night at the slots or poker tables, you're going to have to share some of the lucky proceeds with Uncle Sam. The Internal Revenue Service generally requires that you report your gambling winnings and losses separately when you file your taxes rather than combining the two amounts.

Gambling Winnings 1040 Line 21 Instructions

Record Keeping

As you gamble during the year, you need to keep records of your winnings and losses so that you can support whatever figures you report on your taxes. The IRS permits you to use per-session recording, which means that instead of recording whether you won or lost each time you pull the slot machine, you can simply record your total for the session. Your records should include the date and type of gambling, where you gambled and if you gambled with anyone else, such as a home poker game. If you win more than $600, you should receive a Form W-2G from the casino.

Taxable Winnings

When figuring your gambling winnings, only include the winnings from each session rather than using losses to offset your gains. You have to include gambling winnings even if you didn't receive a Form W-2G from the casino. For example, if you gambled six times during the year, winning $100, $3,000, $4,000 and $6,000 but losing $5,000 and $2,000, your gambling winnings for the year are $13,100. This amount gets reported on line 21 of your Form 1040 tax return.

Gambling Losses

To claim your gambling losses, you have to itemize your deductions. Gambling losses are a miscellaneous deduction, but -- unlike some other miscellaneous deductions -- you can deduct the entire loss. The deduction goes on line 28 of Schedule A and you have to note that the deduction is for gambling losses. For example, if you lost $5,000 on one occasion and $7,000 on another, your total deduction is $12,000.

Gambling Loss Limitation

You can't deduct more in gambling losses than you have in gambling winnings for the year. For example, suppose you reported $13,000 in gambling winnings on Line 21 of Form 1040. Even if you lost $100,000 that year, your gambling loss deduction is limited to $13,000. Worse, you aren't allowed to carry forward the excess, so if you had $87,000 in losses you couldn't deduct last year, you can't use that to offset the gambling income from the current year.

- tax forms image by Chad McDermott from Fotolia.com

Read More:

Recently I was asked to review a return for a new client. He is a professional gambler and he wanted to make sure his previous tax preparer entered the information correctly. This gave me a perfect opportunity to present a case study to compare the differences between reporting as a person who gambles a few times a year with a person whose main activity during the year is gambling as a professional.

Gambling Winnings 1040 Line 21 1040

Non-Professional Vs Professional Gambler

Gambling Winnings 1040 Line 21 Form

A non-professional gambler receives a W2G from the casino and the reported winnings will flow to Line 21 - Other Income on the Schedule 1 of the 1040. The amount of losses can be taken on the Schedule A Line 16. This deduction is limited to the amount of winnings. Also, the non-professional is not allowed to deduct travel, auto or other expenses related to the gambling activity.

The professional gambler also receives W2G forms, and in many cases, large numbers of W2Gs. When these are entered on the 1040, they are attached to the Schedule C for self employment. With the Schedule C, the taxpayer would be able to deduct resonable travel expenses, auto expenses and of course, the gambling losses - with the same deduction limitation. He would also be able to deduct his Self-Employment Heath Insurance and other deductions related to his business. Another benefit from the Schedule C is that the QBI could potentially give the taxpayer an additional 20% decution.

Gambling Winnings 1040 Line 21 Schedule

But there is a catch. The total amount of expense deduction on the Schedule C cannot exceed the total amount of winnings and must show that the majority of the income came from gambling.

Outcome of the Review

When I reviewed his return, I did find a few errors his previous tax preparer made. The taxpayer had almost 200 W2Gs. The tax preparer had mistakenly marked five of the W2Gs to flow to Line 21 - not the Schedule C. This caused the taxpayer to pay a substantial tax payment in error. I amended the return and my new client recently received his refund check from the IRS.